UK Recession: Definite but not definitive

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Mark Smith

Read it in 7 minutes

1200

627

1200

627

Written by Mark Smith

Read it in 7 minutes

Mark Smith

Written by Director of International Debt Recovery & Credit-Control provider 4D Contact, Mark is an invoice-to-cash process expert. He specialises in working in partnership with his clients to build and deliver bespoke solutions which secure cash targets and their customers an outstanding experience.

26 October 2022

Updated version of the article by our CEO Mark Smith which featured in the Q3 2023 edition of Finance Transformation Magazine. As UK Recession looks unavoidable, Mark looks at how UK policy makers can contain its impact.

The UK economic outlook looks bleak. High level inflation, low-level growth, and interest rate hikes loom on the Christmas horizon like the ghost of future cost-of-living doom. The finance markets “stagflation” is now the Bank of England’s Recession. Following the catastrophic 44 day Prime Ministership of Liz Truss and the u-turns over Kwasi Kwarteng’s mini budget, will Rishi Sunak’s government have better luck flattening the Recession curve than Boris Johnson did with flattening that of COVID-19?

There is a growing acceptance that the UK economy will enter a Recession towards the fourth quarter of this year. Latest estimates from Deloitte suggest that activity will fall by a total of 1.6% over three quarters. Thanks to government interventions, this is a significantly smaller contraction than those seen during the pandemic (21.5%) and the financial crisis (5.9%), and most economists are predicting growth to resume by the second half of 2023.

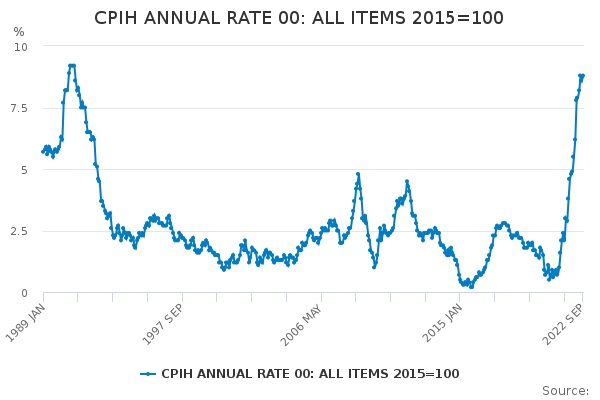

The Impact of Inflation

UK inflation hit 10.1% in July, a 40-year high. With Kate Bush topping the charts, Top Gun at the cinema, strikes and an energy crisis you could easily think you were back in the 1980s!

At the heart of the current inflation crisis lies the basic economic principle of the effect of supply and demand on price. Whether it is the impact of the COVID-19 pandemic, the fall-out from the Ukraine conflict or the perfect storm of global events that has led to the current energy crisis, the inability of supply to meet demand have driven price inflation.

Deloitte’s latest predictions suggest UK inflation will peak at 11% this winter as these underlying inflationary pressures remain strong. Core inflation, which strips out the impact of energy and food prices, is currently 6% – the highest level in 30 years. These price pressures are widely predicted to remain throughout most of 2023 before recovering in 2024.

The impact of inflation on the economy is not to be underestimated. Inflation is affecting consumer spending power at a speed that has not been seen in decades and it is also having a devastating effect on business. Spiralling costs, a tight labour market and weaker demand, post-Brexit difficulties with international shipping, uncertainty in capital markets, geo-political uncertainty compounded by the end of government Covid support measures make it a tough environment for businesses to thrive or even survive.

In these conditions an economic contraction is unavoidable. In August the number of companies in England and Wales declared insolvent jumped by 43% with 1,933 insolvencies. This was 42% above the level in August 2019, before the COVID-19 pandemic hit.

For the first time since the pandemic there was a month on month increase in the administration and CVA figures (43% for administrations and 160% for CVAs). This suggests that more live businesses are reaching for insolvency and restructuring protection.

Owning the Inevitable

With some form of Recession inevitable, policy makers must now shift their focus from avoidance to containment and prioritise strategies which will shorten and soften the contraction. In the current situation this can only be achieved by dampening demand and curbing inflation.

The UK’s energy support package is a massive response to the cost-of-living crisis, expecting to cost the taxpayer nearly twice the COVID furlough scheme. The scale of its cost and reach has staggered supporters and critics alike. Much lower energy prices will help lower the peak in inflation, delivering a shallower downturn as well as reducing the squeeze on household income. But it will not be a magic bullet and consumers will still feel the inflationary pinch on their spending power.

The fact that energy subsidies will bring down inflation, and that the economy is already slowing, has not changed the view in financial markets that interest rates are heading sharply higher as the Bank of England will make its own moves to control inflation. UK interest rates have already risen to 2.25 and are predicted to peak at around 4.5% next summer.

At What Cost?

Without question this will all come at a cost – fiscal interventions rarely come without some form of fallout.

Interest rate hikes and inflation will substantially increase companies’ costs. This combined with weaker demand will squeeze corporate margins, driving both corporate cost-cutting and an increase in insolvencies. Cost-cutting equates to further reductions in investment and a rise in unemployment as companies streamline – and thus, the cycle of Recession begins.

The recent sweeping tax cuts announced in Kwasi Kwarteng’s mini budget, a move designed to “turn the vicious cycle of stagnation into a virtuous cycle of growth” caused the pound to plummet. Financial markets struggled to reconcile the reality of monetary tightening at the same time as fiscal loosening. The global concern over the potential economic impact of the mini-budget was so strong that the International Monetary Fund took the unprecedented step of publicly commenting on a nation’s economic policy.

Following his appointment as Prime Minister Rishi Sunak’s first policy decision was to delay the announcement of a plan for repairing the country’s public finances until Nov. 17, two-and-a-half weeks later than previously scheduled.

It is widely expected that the new budget, which will be fully audited by Britain’s fiscal watchdog unlike Truss’s mini-budget will cancel tax cuts and include aggressive spending cuts. The Government will need to deliver both big savings and find extra revenue. No 10 is also refusing to guarantee many of the Liz Truss administration promises including spending 3% of GDP on defence, the supply-side reforms and the cancellation of the national insurance increase.

“I have been honest. We will have to take difficult decisions to restore economic stability and confidence,” Sunak told parliament,

The budget delay has had a relatively minor impact on the overall stability of the UK economy as the Sunak and Jeremy Hunt partnership is widely regarded as willing and able to tackle the hole in Britain’s public finances. Indeed the IMF have once again spoken out with chief Kristalina Georgieva saying “I listened carefully to him talking to the British people, and this is a message that should resonate across the world. These are tough times, and tough times require tough decisions,”

With the interest rate paid on government gilts falling and the international gas price coming down following a warm November there is some confidence that it may be necessary to make more minor changes to the public finances than initially thought to rebuild stability However, there will be no quick fix to the current economic crisis. With high inflation and interest rates suffocating economic growth recession is now inevitable. Whilst interventions by both the Bank of England and the Government will hopefully reduce its impact, it will in the short-term cause significant disruption. Economic stability cannot be rebuilt overnight and we can expect a turbulent 9 months for corporations and consumers alike.

Author: Mark Smith

Director of outsourced credit management solutions providers Barratt Smith and Brown and 4D Contact, and a major share-holder in fintech company Invevo, Mark has over 30 years of experience providing clients build strategic process solutions to mitigate challenging financial markets.

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide