The role of third-party debt collection in the receivables process.

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Heather Leveton

Read it in 5 minutes

1200

627

1200

627

Written by Heather Leveton

Read it in 5 minutes

Heather Leveton

Written by Marketing Director of International Debt Recovery & Credit-Control provider 4D Contact. With a CV which includes Marketing and Managing Director roles within Time Warner businesses, Heather has experience in developing and implementing strategic business plans that meet financial targets and deliver long-term business growth. She played a key role in building market-leading premium TV brands such as Band of Brothers, The Sopranos and Friends in the UK and also in heading up HBO's expansion into the International home entertainment market.

27 March 2025

However efficient their inhouse collections team, all businesses have accounts which become overdue. Whether it is due to a change in a customer’s financial circumstances, cash flow management or simply poor payment practices, late payments are an inevitable fall-out of operating on open credit. They often start as a trickle with one or two accounts falling past due each week. But over time one or two accounts will quickly become a vast spreadsheet and impact those critical measures of DSO (day sales outstanding) and BDA (bad debt allowance).

Under-invested and under-resourced, in-house credit-control teams are often overstretched. Forced to operate at full capacity, when staff members leave, fall sick or take vacation, the workload can quickly become unmanageable. Finding replacements isn’t easy and new hires can take months to get up to speed.

Add the additional workload of chasing late payments into the mix and overstretched can easily become overwhelmed. This can lead to a drop in the effectiveness of credit-control activity, and more and more accounts falling past-due. Without intervention, the situation only worsens, as productivity drops, team members can become discouraged, hiding behind spreadsheets as cash collection falls and DSO increases.

It is critical to recognise when it is no longer realistic to service a debt in-house and to have a business agreed escalation process. As Einstein (allegedly) said, “the definition of madness is doing the same thing again and again and expecting a different outcome”. If an account has been through your in-house credit-control process and still remains unsettled, clearly it is necessary to do something different to help secure payment.

For most businesses the next step will be to pass the debt to a third-party debt collection partner. When a debtor receives a letter of instruction, it is a signal that you are moving the debt through a process, and that you are prepared to utilise all the tools at your disposal to secure payment. It is indication that the final step will be legal action. This simple step change is so effective that 40% of debts are settled within a week of escalation to third-party.

A specialist outsourced debt recovery team has the capacity and expertise to chase persistent non-payers, driving cash collection and reductions in DSO and bad debt. It is the primary function of their business and they are therefore experts in persuasion, negotiation and objection handling. By removing the burden of chasing overdue invoices, the in-house team can avoid becoming overwhelmed. They can maintain focus on delivering high-quality credit control, minimising the number of accounts falling past due.

Using a combination of in-house and outsourced resources will ensure you optimise the effectiveness of your cash collection process. In addition, you will often also enhance customer experience and increase sales. By ensuring disputes and queries are quickly identified and resolved, you can prevent customers being unnecessarily placed on stop, unable to trade and potentially taking their business elsewhere.

“In any situation, the best thing you can do is the right thing; the next best thing you can do is the wrong thing; the worst thing you can do is nothing”.

Theodore Roosevelt

Despite the clear challenges, many businesses hesitate to include outsourced debt collection in their process. Common fears include the potential impact on customer relationships, reputational risk, and concerns about data security. Business owners worry that outsourcing may add to the in-house team’s workload, increase costs, and result in a loss of control over the debt collection process.

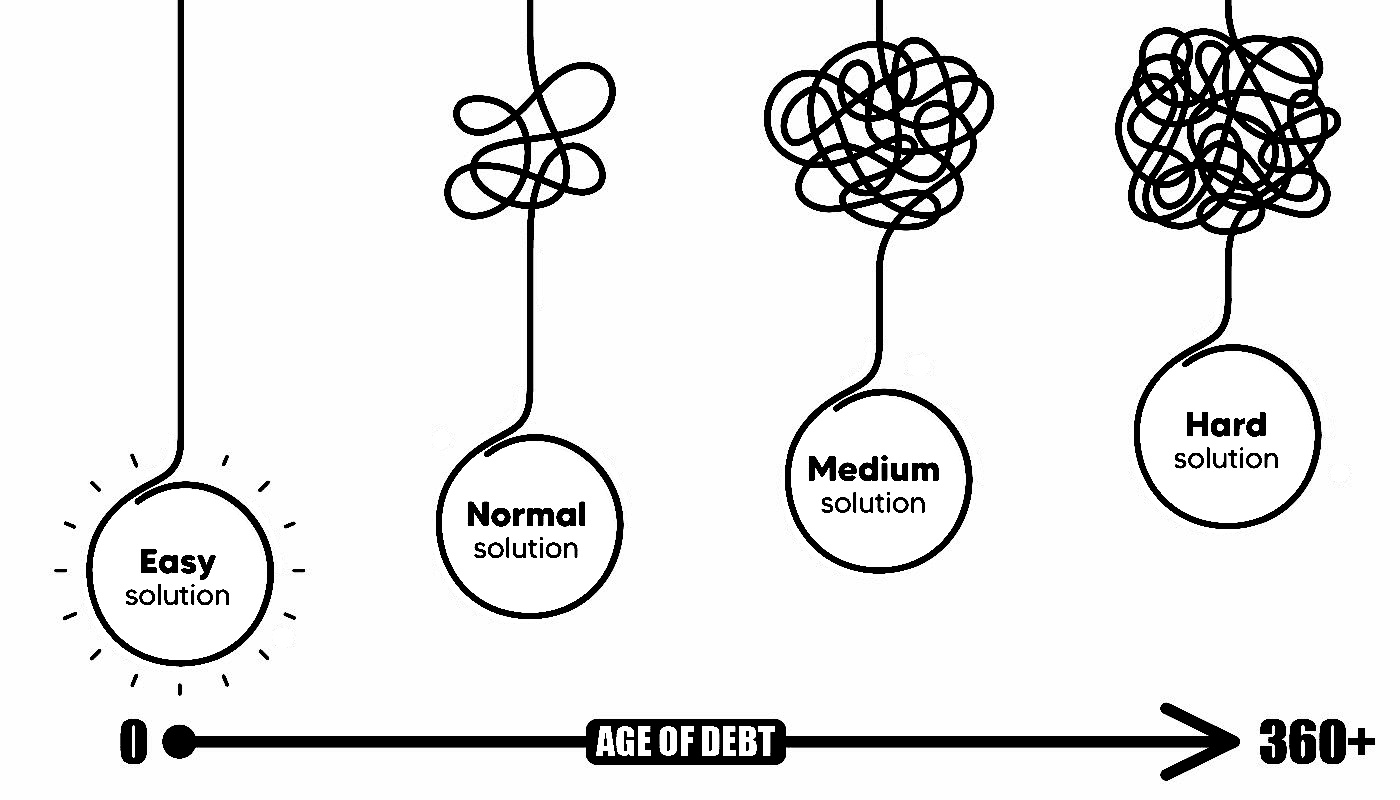

There is also doubt about the effectiveness of third-party services. Some wonder what an outsourced team can do that can’t be accomplished in-house. Additionally, there is apprehension about starting down a path that might lead to complete outsourcing of debt collection. These uncertainties often lead to inaction, giving competitors a head start and leaving businesses with ageing debt ledgers that are more complex and expensive to collect.

Selecting the right partner for third-party debt collection is crucial. It requires a balance of bravery and caution—being bold without being reckless. The ideal partner should align well with your business’s values and operational needs.

Look for a partner with a proven track record, robust data security measures, and a clear understanding of your industry. Effective communication and a collaborative approach are essential to ensure smooth integration and successful outcomes. Taking the time to find the right fit can significantly enhance the effectiveness of your debt collection efforts.

To future-proof your receivables cycle, it’s essential to be proactive rather than reactive. Delaying the decision to integrate third-party debt collection can lead to ageing debt ledgers that are increasingly difficult and costly to manage.

By acting decisively and incorporating third-party services, you can mitigate the risks of inaction. This strategic move ensures that your business remains competitive, maintains healthy cash flow, and minimizes bad debt. Embracing third-party debt collection as part of your receivables process can set your business on a path to sustained financial health and operational efficiency.

Author: Heather Leveton

If you are looking to optimise your cash collection and would like to discuss how 4D Contact can help, please click here to request a call back.

Contact us now at: sales@4dcontact.com or on 020 37737854

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide