Outsourced Credit-Control Case Study: Schindler UK

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Heather Leveton

Read it in 7 minutes

1200

627

1200

627

Written by Heather Leveton

Read it in 7 minutes

Heather Leveton

Written by Marketing Director of International Debt Recovery & Credit-Control provider 4D Contact. With a CV which includes Marketing and Managing Director roles within Time Warner businesses, Heather has experience in developing and implementing strategic business plans that meet financial targets and deliver long-term business growth. She played a key role in building market-leading premium TV brands such as Band of Brothers, The Sopranos and Friends in the UK and also in heading up HBO's expansion into the International home entertainment market.

9 September 2021

This case-study from Schindler highlights how the strategic use of outsourced credit-control can help improve process efficiency, customer service and cash flow. The 4D Contact team have extensive experience supporting global businesses in their credit and collections function. We can provide a flexible outsourced credit-control service to support your in-house team, as well as developing and implementing creative change management solutions to support user adoption when teams find change difficult.

So, looking to improve the efficiency and effectiveness of your credit and collections process, and reduce cost to serve, you’ve invested heavily in a new credit and collections software system. Months have been spent with stakeholders at all levels across the business, to ensure it meets your business requirements and has secured cross function buy in. The change management program was comprehensive, as was end user training. Then why, several months post-implementation, are you not seeing the results you expected?

This is an all too familiar story for many businesses which have delivered a software transformation within their order-to-cash process. And it is precisely, the situation Schindler UK found themselves in after implementing their credit and collections software solution, MIA, until they turned to 4D Contact for support.

Through the strategic use of their outsourced credit-control service, 4D Contact enabled Schindler to:

Schindler’s Swiss-engineered elevators, escalators and moving walks keep the urban world moving, safely, comfortably and efficiently, 24/7 worldwide. A forward-thinking business, with a major focus on sustainability, Schindler pride themselves of being in front of the game when it comes to adopting new technologies to drive efficiency.

In order to ensure they deliver their net working capital targets and reduce both their bad debt allowance (BDA) and cost-to-serve, Schindler UK invested in implementing a credit and collections automation system MIA. The system would provide them with the data insight and analysis to make more strategic decisions on how best to manage each individual customer based on their historic payment behaviours avoiding unnecessary calls and nudging those accounts that would need it –ensuring optimal efficiency in their credit and collections processes.

The data- based workflows that MIA enabled, highlighting who to call and when, were critical for Schindler to improve the efficiency of the collections team. With a total of 4,585 accounts to manage, ranging from key construction clients with accounts worth £100,000+ to small maintenance customers, which could be £500 – touching every customer would be impossible. However, without access to data to inform their decisions, the team had fallen into the habit, common in many collection teams, of simply focusing on the key accounts that they had built relationships with and ignoring the rest of the ledger. In value terms this meant that they were only chasing 30% of revenues, leaving over 4,000 accounts worth 70% of total revenues untouched.

However, several months post-implementation of MIA, Schindler UK were still not seeing the results they desired. Analysis of data from MIA uncovered that in spite of extensive training to onboard them onto the system, the inhouse team had fallen back into their historic working practices and rather than following the workflow recommendations from MIA were still:

This meant they were still only touching the 13% of accounts – leaving the other 87% (worth 70% of revenues) untouched.

In April 2018, aware that the system had not resolved the inherent issues within the inhouse teams working practices, Schindler engaged 4D Contact to provide them with outsourced white-label credit-control support. Their primary objective was to improve cash collection and reduce BDA through increasing the level of customers receiving voice contact.

4D Contact were given 4,011 of the total 4,585 accounts and were targeted to achieve 100% coverage. With 4D Contact managing the high volume of smaller accounts, the Schindler inhouse team could focus on the areas where they could most add value – their key accounts and query management.

4D Contact placed 6 dedicated agents onto the Schindler contract. Targeted with delivering the customers voice contact they were the antithesis of the email led Schindler inhouse team with each agent averaging 60 outbound calls each day. If they hit a dispute, they would hand it back to the Schindler inhouse team for resolution and move onto the next customer.

The project has been an outstanding success and has been extended from an initial pilot to an ongoing contract.

Since engaging 4D Contact in April 2018, Schindler has seen 290% improvement in networking capital

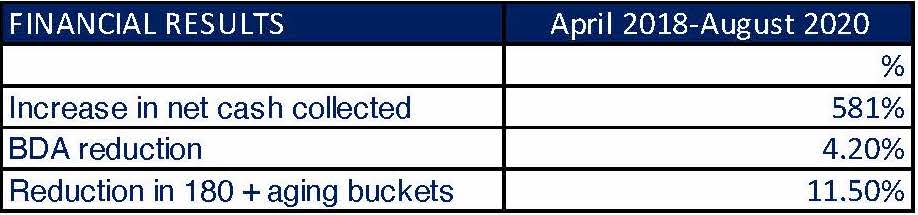

In addition to exceeding their net working capital targets, with 4D Contact’s white-label outsourced credit-control support Schindler also saw substantial improvements in their cash collection, BDA and aging buckets as outlined below:

Whilst the financial metrics outlined above speak for themselves, it is the effect on Schindler’s customer relations which can arguably be considered the most impactful. Many customers had never been contacted by Schindler and were delighted to receive a call. The increased level of customer contact uncovered significant upstream issues with invoicing and billing that were generating customer frustration. In the current global marketplace, where it is generally accepted that share will be won as much on customer service as on product and price, these issues needed to be urgently addressed as they could potentially lead to a loss of business. By engaging 4D Contact and ensuring these customers received the contact required, Schindler UK were able to not only resolve these disputes and secure payment, but also work with the relevant internal teams to get these issues permanently resolved.

In addition, with the 4D Contact team utilising the MIA system as it was intended, the inhouse team could see how effective the system was at improving the efficiency of their collections activity. With the 4D Contact agents providing a best-in-class example, the Schindler inhouse team increased their engagement with the system. This led to improvements in the cash collection from the key accounts, further supporting the outstanding financial results.

Summary

By delivering a high-quality, white-label, credit-control service, 4D Contact have enabled our client to achieve transformational results. Through engaging 4D Contact to provide them with voice-led credit-control, Schindler UK not only helped manage their front-line staff transition smoothly into better working practices, but also achieved their commercial objectives of improving their process efficiency, customer service and cash flow.

To quote Richard Clow, Head of Controlling at Schindler UK:

“Further to engaging 4D Contact to support our credit-control function, Schindler UK has achieved our aim of negative working capital, three years ahead of plan. We also significantly reduced our 180+ ageing buckets and resolved our in-house issues over user engagement with our accounts receivables software system MIA. This has enabled us to redeploy staff to other tasks within the finance function, delivering even greater efficiencies, as well as maintaining our valued headcount. Although I would not want Mark and his team to steal all the credit for our outstanding financial and commercial results, I am in no doubt that without their support Schindler would not be in the strong cash position we are today.”

Richard Clow, Head of Controlling, Schindler UK

4D Contact – an overview

Founded in 2018, by Moreton-Smith Receivables co-founder, Mark Smith and ex Moreton-Smith CRO, Richard Brown, 4D Contact have quickly established themselves as a key player in the UK outsourced international credit management market. Offering a full suite of credit management services, from permanent outsourced credit-control to ledger clear ups and more, they specialise in developing high-touch, voice-led solutions, that deliver results whilst balancing those all-important customer relationships for blue-chip clients such as Schindler UK, Travis Perkins & Allegan. With offices in London, Dublin and Malaga, Spain, 4D Contact are ideally placed to manage the EU/UK cross-border complexities post-Brexit and ensure their clients experience an efficient and effective service wherever their customers are located.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide