Building Resilience Through Effective Credit Management

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Heather Leveton

Read it in 4 minutes

1200

627

1200

627

Written by Heather Leveton

Read it in 4 minutes

Heather Leveton

Written by Marketing Director of International Debt Recovery & Credit-Control provider 4D Contact. With a CV which includes Marketing and Managing Director roles within Time Warner businesses, Heather has experience in developing and implementing strategic business plans that meet financial targets and deliver long-term business growth. She played a key role in building market-leading premium TV brands such as Band of Brothers, The Sopranos and Friends in the UK and also in heading up HBO's expansion into the International home entertainment market.

26 August 2021

Often overlooked in the good times, effective credit management is critical in a downturn when maintaining cash flow is key to ensuring resilience. Post Covid-19 many businesses have had their eyes opened to the importance of building resilience through effective credit management and the stark difference between cash in the bank and cash on the balance sheet.

Prior to the Covid-19 crisis resilience was barely discussed in the boardroom. Indeed, less than half of all respondents in the August 2019 McKinsey Global Survey, said that corporate resilience was on their current board agenda and only one-fifth believed that a lack of corporate resilience was a significant challenge for their organisations. Fast forward 6 months to April 2020 as the Covid-19 pandemic forced the world into lockdown and corporate resilience was now top of the board’s agenda as they rose to the challenge of a global health and economic crisis.

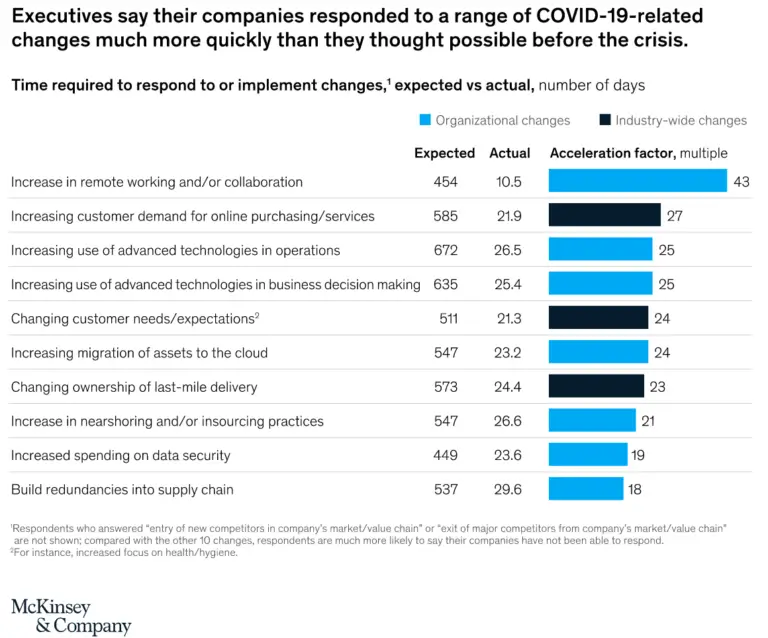

Building corporate resilience within the Covid-19 pandemic was no simple task. It required boards and management teams to make fast, fundamental changes to the way they and the business operated. As the below chart from the McKinsey Survey How COVID-19 has pushed companies over the technology tipping point—and transformed business forever, October 5, 2020 demonstrates, business made changes far quicker than they thought possible before the crisis.

As workforces adapted to home working, and businesses digitally transformed at an exponential speed to facilitate it, one thing became clear – in a crisis, cash flow is king. Access to working capital is critical to not only ensure the business has the resilience to weather any economic downturn, but also can access to the capital necessary to adapt to meet the demands of the crisis and maintain continuity.

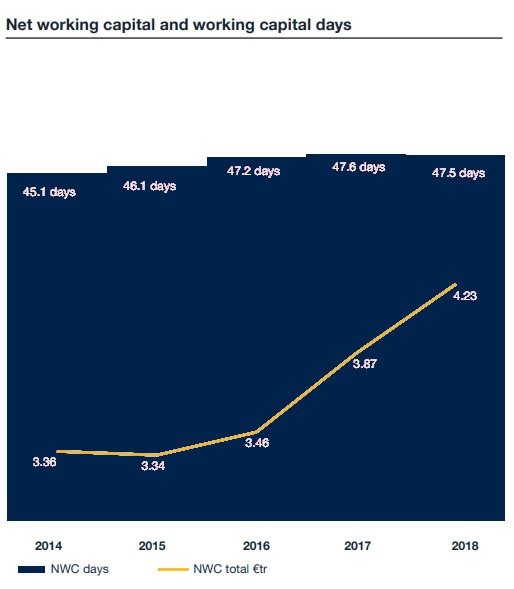

In terms of working capital, it is fair to say that Covid-19 caught corporations across the globe with their trousers down. Very few businesses had plans in place to deal with a global pandemic and the economic implications of a 12-month global lockdown. Indeed, the PWC Working Capital Report 2019/20: Creating value through working capital, put global excess working capital tied on the balance sheet in 2018, on the eve of the pandemic at 1.2 trillion euros – with most sectors demonstrating a year-on-year decline in net working capital.

As many corporations saw sales dwindle due to massive shifts in demand driven through the lockdown restrictions, suddenly accessing that cash on the balance sheet became a priority and often overlooked credit management teams found themselves in the spotlight.

Post pandemic, many businesses have learnt the importance of effective credit management in building resilience. Effective credit management not only places the business in the best cash position possible to weather the storm but also provides critical insight into customers financial positions. This customer insight can enable the business to implement a crisis credit management strategy that balances customer relationships and long-term revenue opportunities, with minimizing risk and delivering immediate cash requirements. Decisions, such as offering extended payment terms can be made on sound financial understanding of what the business can afford and with clear guidelines for the criteria to be met before they are offered to customers – this might include no previous payment defaults, the customer account being up to date bar most recent invoice or other key indicators.

Ensuring the business can adapt, adjust, and survive a crisis is now a key concern for most corporate boards. This new focus on ensuring resilience will have a far-reaching impact on how businesses are run – from improved strategic planning to better financial management. In this environment credit management has risen significantly in profile, moving from the windowless back office to the board room as business realise that the measures of net working capital and DSO, so often ignored in the good times, are critical in a crisis. This new understanding of the role of effective credit management in building resilience should ensure its place on the corporate agenda for many years to come.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide