7 factors critical for successful invoice-to-cash centralisation or outsourcing

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Richard Brown

Read it in 7 minutes

1200

627

1200

627

Written by Richard Brown

Read it in 7 minutes

Richard Brown

Written by Director of International Debt Recovery & Credit-Control provider 4D Contact, Richard has over 25 years of experience helping global businesses optimise the efficiency of their credit and collections processes to meet commercial objectives.

14 May 2024

Investing in a shared service centre or moving your invoice-to-cash process to an outsourced partner does not automatically guarantee cost efficiencies and an improvement in the quality-of-service delivery. Considering the gains can be so substantial, it is surprising how many businesses find that they fail to secure the results they had anticipated.

As with any business transformation project, success will ultimately be contingent on the strength of your transformation plan – from concept, through delivery to embedding change, the development of a realistic and actionable project roadmap will be critical to success. As Michael Ryan, leading UK finance transformation specialist states:

Our latest article take a look at 7 areas which will be critical to the success of your invoice-to-cash centralisation or outsourcing plan.

Executing transformation projects requires a specific skill set. Whether you choose to outsource to a consulting agency or bring expertise in-house, it is critical to have the right team with the right skills in place.

Consultants that specialise in financial transformation projects will have the distance and experience to see beyond the today, to the future potential and then the vision to outline the journey to get there.

Accessing the right expertise can help your business avoid common pitfalls and ensure you achieve your objectives from invoice-to-cash centralisation or outsourcing quickly and cost efficiently.

As with any business transformation project, it is critical to be clear about what you want to achieve and how you are going to achieve it. Concrete, measurable objectives create the framework which enables the business to achieve longer-term, more vision-based business goals such as growth. Without objectives to create actionable structure, change projects will invariably cost more in time, money and resource and are ultimately unlikely to be successful.

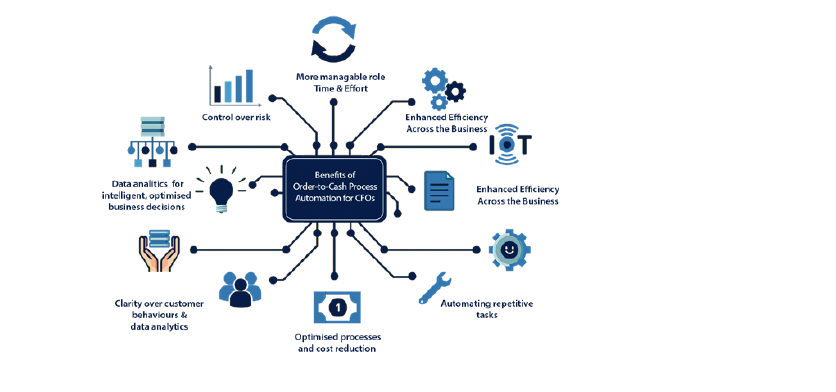

Whilst cost savings are often the driving objective for invoice-to-cash centralisation or outsourcing, the other potential benefits such as greater controls, employee development and flexibility and scalability should also be identified at this stage. Whilst one objective may seem imperative at the outset, it is surprising how some of the other secondary objectives deliver the greatest business wins.

Companies which have grown rapidly through business expansion or acquisition can often find themselves with processes which are held together with band aids. It is hard for any team which is working at full tilt in the business to find the time or the objectively to work on it.

Centralisation provides the opportunity to review your overall business needs and goals and build the right processes to deliver them. Getting this piece right will be critical to the success of your centralised shared service centre’s or outsourced partner’s cash collection. Ultimately, if the process isn’t right, nor will the results be.

Central to building effective processes is the ability to make data-based decisions on how to optimise your collections activity. Unfortunately, most ERP solutions are still distinctly inadequate in terms of credit and collections functionality. You may have a module in your system today, but do collectors still need to manage data in vast excel spreadsheets?

Key to successful centralisation, and indeed often one of the key drivers for it, is the implementation of a collections software solution. Collating all information on your customers payment patterns and behaviours into a centralised data warehouse, these software solutions enable touch of button data analytics and reporting to help you:

You can establish ground-breaking processes and invest millions of the pounds in the most advanced AI driven collections software solution but if you fail to engage your employees, you will fail to deliver results. Those working within the shared service centre, as part of an outsourced team, and those utilising either resource, all need to be onboard with the strategy you agreed within the planning stage.

Throughout the implementation process is will be critical to remind team members of the organisation’s vision and why change is necessary and support your employees to take the necessary steps to achieve the goals of the initiative.

When setting your objectives from your invoice-to-cash centralisation or outsourcing project it is critical to understand what success looks like and the parameters for measuring it. It can be tempting to rely on bench-marketing against competitors or industry standards to set goals and targets, but if their business goals are different from yours or they are 5 years down the line on their business process centralisation journey these targets will not reflect your businesses unique needs.

Success will be defined and measured differently by every organisation as it should be tied to each company’s overall business goals. If your company’s overall objective is to deliver best in class customer service to improve customer retention, then any wins in this area such as a reduction in the number or improvement in the speed of resolution of disputes will be of equal importance and the financial metrics such as reduction in ageing buckets and DSO.

It is important that any targets set are both realistic and achievable within the agreed timeframe and establish regular monitoring and reporting to understand progress. This will not only be critical to maintaining moral and momentum but also enable any tweaks and adjustments to be made to strategies, systems, and processes to ensure overall goals can be met.

It is important to remember that the only constant is change itself and as you embark on your invoice-to-cash shared service or outsourcing journey it is key to keep re-evaluating whether your original roadmap is still appropriate and on target to meet your overall business objectives.

To help businesses avoid common pitfalls, we have developed a guide to delivering successful cash collection in a shared service facility.

What you’ll learn in this guide:

Whether you manage your cash collection from a shared service centre or are an independent team, 4D Contact have extensive experience providing outsourced credit-control and debt recovery solutions to help businesses meet their cash targets. Contact us now at: sales@4dcontact.com or on 020 37691487.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide