European Credit Management Industry Trends for 2022

4D Contact, Global Debt Recovery and Credit Management ServicesWritten by Mark Smith

Read it in 5 minutes

1200

627

1200

627

Written by Mark Smith

Read it in 5 minutes

Mark Smith

Written by Director of International Debt Recovery & Credit-Control provider 4D Contact, Mark is an invoice-to-cash process expert. He specialises in working in partnership with his clients to build and deliver bespoke solutions which secure cash targets and their customers an outstanding experience.

12 May 2022

European credit management teams will be hoping for an ease from the pressures of maintaining cash flow during the pandemic. However, with the economic outlook characterized by a high-level of uncertainty, building resilience looks set to remain a key priority for businesses across Europe. With liquidity one of the key factors to building resilience, credit management is likely to remain in the corporate spotlight for the foreseeable future.

This increased focus will provide both opportunities and challenges for European credit management teams. There will be substantially increased pressure to improve DSO and achieve working capital targets in a challenging market. However, there is also likely to be greater investment and support in the delivery of these targets.

Outlined in this article are some of the key trends we believe will be seen in European credit management in 2022.

There is growing understanding that traditional business models made of functional rather than process focused teams are inefficient and ineffective. They deliver fragmented viewpoints, disparate data, and internal competition, which benefit neither the customer nor the company. Businesses’ will need to move beyond functional team structures and reimagine processes from end to end if they are to remain competitive in the new normal and beyond.

In 2022, with an optimistic but high-risk economic outlook, it will be more critical than ever for European businesses to deliver efficient and effective cash collection. However, too many businesses still operate their collections process off vast spreadsheets – and are suffering the financial consequences of these outdated, inefficient processes.

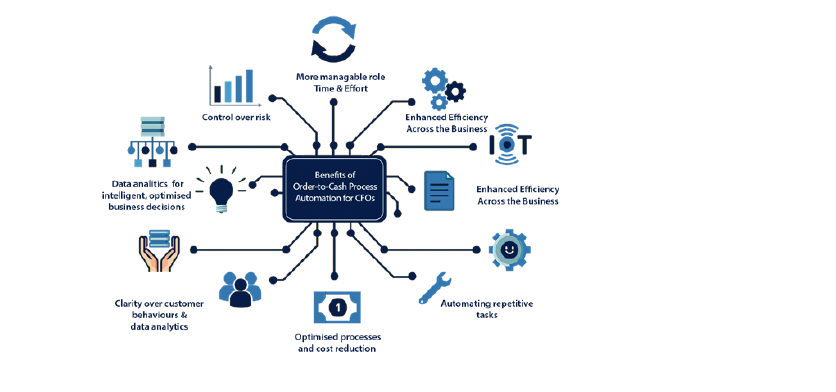

Digital transformation is key to achieving optimal efficiency and effectiveness within the order-to-cash process. Digital transformation of the order to cash function can provide the transparency, real-time intelligence and data-based insight to deliver truly transformation results. The right solution will provide visibility over legacy processes that have previously been either inaccessible or incredibly complex to find and enable data-based decisions that will drive cost efficiencies and process improvements.

Effective realignment of supply chain, customer service, finance and credit management teams will be impossible unless issues around access to centralised, real-time data are resolved. Issues which can only be resolved through the adoption of digital solutions. Businesses that fail to transform will be left behind.

“the future will belong to companies that put technology at the center of their outlook, capabilities, and leadership mandate” McKinsey

https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-new-digital-edge-rethinking-strategy-for-the-postpandemic-era

Tied to the forecast growth in digital transformation is greater automation within the order-to-cash process. AI machine learning will enable the automation of repetitive tasks and allow the human workforce to focus on the areas where they can really add value. The critical role this will play in the future of credit and collections can be seen in the forecast growth for the market – practically doubling in size from 2019 – 2024.

Businesses have become increasingly aware of the key role customer experience plays in building and maintaining market share and there is a growing focus on ensuring a positive experience at all customer touch points. With most marketplaces highly competitive, deliver a poor customer experience (CX) anywhere during the customer journey and you risk wasting valuable time and resources on customer acquisition only for them to take their business elsewhere.

Often considered to be merely a financial process to maintain cash flow, collections in fact have a critical role to play in customer relationship management. By placing customer outcomes at the heart of collections activity, collections teams can strengthen customer relationships, developing long-term loyalty which will reduce churn and secure advocacy to support growth.

For those in the business of outsourcing, the need to facilitate remote working during the Covid-19 pandemic has had a fortunate consequence. Outsourcing has historically faced similar barriers to adoption to remote working. Fears over control, data security, and effective management processes have meant many businesses have resisted making the leap and continued to work solely with inhouse teams – even when this meant an accumulation of ageing ledgers and increasing DSO due to the limitations of resource.

However, the shift to remote working during the pandemic meant businesses were forced to overcome these issues to maintain business continuity. Now they have made the leap for internal teams, the step to accepting the support of external teams has shortened. With the continued pressure from the board to maintain cash flow, increased outsourcing to bridge inhouse resource gaps seems likely – and will potentially include a growing percentage of businesses which have never previously used an outsourced credit management or debt collection provider.

Author: Mark Smith

If you have a challenge within your credit and collections process and would like to discuss how 4D Contact outsourced credit management solutions could help, please click here to request a call back.

Contact us now at sales@4dcontact.com or on 020 37691487 for a no-obligation quote.

![[TOFU offer] eBook – A C-Suite executive’s guide to Delivering successful order-to-cash transformation](https://www.4dcontact.com/wp-content/uploads/2019/08/img-ebook-preview-order-cash-transformation.png)

A review of the considerations and tactics critical to achieving successful transformation within your order-to-cash function

Download free guide